60 Years of Expertise &

Legal Experience

Articles

BORROWING AND LENDING OF THE CAPITAL MARKET INSTRUMENTS UNDER TURKISH LAW

Borrowing and lending of the capital market instruments are regulated under the “Communiqué on Credit Purchasing, Short Selling, Lending and Borrowing of Capital Market Instruments (Serial:V, No:65)(Official Gazette dated 14.07.2003, numbered 25168)”. The definition of the borrowing and lending of the capital market instrument is defined in article 31 of the Communiqué. According to the article, borrowing and lending of the capital market instrument mean the issuance of capital market instruments for a certain period of time and the return of the same type of capital market instrument to the lender by the borrower within the framework of the principles set forth in the relevant framework agreement.

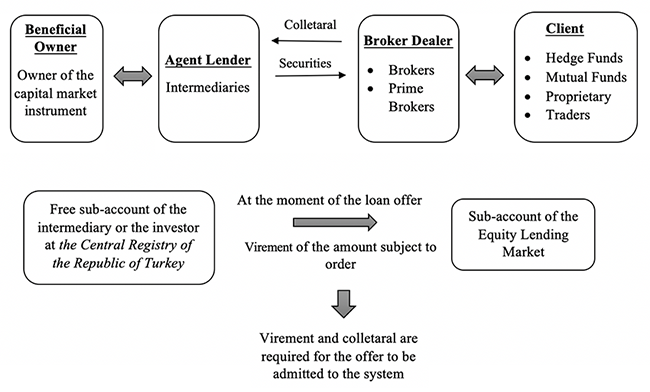

Pursuant to Communiqué, for the transaction purposes “Takasbank Equity Lending Market” is established. Takasbank Equity Lending Market is an organized market where the demands of intermediaries to borrow securities and mutual funds participation certificates by establishing collateral and the demands of intermediaries who have the desire to lend capital market instruments meet. In this market, the exchange is made at the time of the transaction. Takasbank operates as an institution that mediates and terminates exchanges within the scope of transaction guarantees. Although Takasbank acts as an operating institution, it is not a central counterparty to the lending transactions.

Capital market instruments that can be subject to lending transactions in Equity Lending Market are securities and mutual funds participation certificates. The borrower is not under the obligation to return the capital market instruments in the exact kind of the purchased. It is sufficient to return a fungible capital market instrument on the maturity date.

It is accepted that the ownership rights of the securities and participation certificates, which are the subject matter of the lending, are transferred to the borrower. Although the ownership of the borrowed instruments passes to the borrower, some rights related to the instruments subject to the borrowing transactions remain with the lender. The financial rights arising from the instruments subject to the lending transaction in the Equity Lending Market remain in the lender. These rights are as follows:

1. Right to capital increase through rights issues

2. Right to capital increase by a bonus issue

3. Right to dividend

While the lender keeps these rights, the voting right which is attached to equity remains in the rights of the lender. On the other hand, the lender has the right to recall the instruments if after the transaction the issuer of the shares announces general assembly date which coincides with a day before the due date of the general assembly meeting. In the event that dividend or interest is paid by the issuer before the instruments are returned to the lender, such payments must be paid by the borrower to the lender within the framework of the framework agreement.

In practice, it is common to borrow a capital market instrument and to make

that instrument subject of a short selling . The logic behind this practice lies with the possible expectation regarding a decrease in the value of the relevant capital market instrument. If an investor foresees a possible decrease in a stock price, he/she could borrow that instrument and sell it to any other buyer. In this scenario, the borrower still obliged to return the fungible instrument to the lender on the maturity time. But by that time, if the stock price of the relevant instrument decreases, the borrower could purchase that instrument again. Since the borrower purchases that instrument at a price lower than before, it will generate a profit in favor of the borrower.

In the capital markets, prior to the registration system, the agreements of the parties are followed by the matching of the orders through Takasbank. With the registration system, lending transactions are executed in accordance with a procedure that was established in conjunction with the systems of the Central Registry of the Republic of Turkey (Merkezi Kayıt Kuruluşu A.Ş.) and Takasbank. The given orders match based on prioritizing the orders with the lowest commission rate and the highest bid. It should be noted that the annulment of the realized transaction is not possible.

The transaction process is as follows:

1- Intermediary institutions that wish to transact in the market are required to sign the “Equity Lending Market Commitment” determined by Takasbank and notify their representatives to the Bank.

2- It is the sale of securities that are not owned by the borrower. Retrieved from https://www.borsagundem.com/p/borsa-terimleri-sozlugu